Facts About Property By Helander Llc Uncovered

Wiki Article

All About Property By Helander Llc

Table of ContentsSome Known Questions About Property By Helander Llc.What Does Property By Helander Llc Mean?The 9-Minute Rule for Property By Helander LlcThe Main Principles Of Property By Helander Llc Our Property By Helander Llc DiariesLittle Known Questions About Property By Helander Llc.

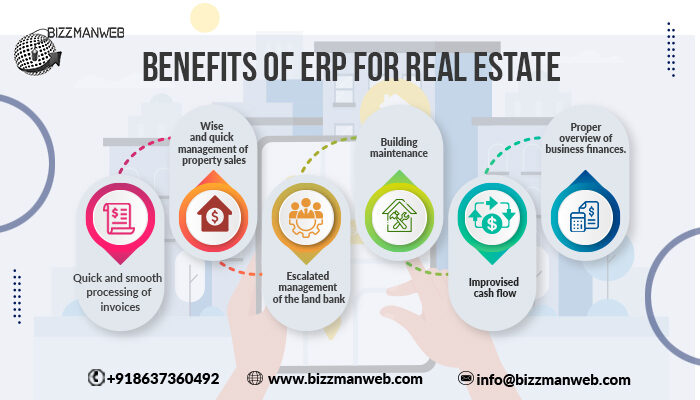

The advantages of investing in genuine estate are countless. Here's what you need to understand concerning real estate advantages and why real estate is thought about a good investment.The advantages of spending in actual estate consist of passive earnings, stable cash money circulation, tax obligation benefits, diversity, and take advantage of. Actual estate financial investment depends on (REITs) supply a method to invest in real estate without having to possess, run, or finance residential properties - https://pxhere.com/en/photographer-me/4310130. Cash circulation is the net income from a real estate financial investment after mortgage payments and business expenses have actually been made.

Oftentimes, money circulation only reinforces in time as you pay down your mortgageand construct up your equity. Actual estate investors can make the most of countless tax breaks and reductions that can save cash at tax obligation time. Generally, you can deduct the sensible costs of owning, operating, and managing a home.

Getting My Property By Helander Llc To Work

Realty worths tend to boost in time, and with a great financial investment, you can transform an earnings when it's time to market. Rental fees additionally tend to rise over time, which can result in higher capital. This graph from the Reserve bank of St. Louis reveals average home rates in the united stateThe areas shaded in grey show U.S. recessions. Typical List Prices of Houses Marketed for the USA. As you pay for a home home mortgage, you construct equityan property that belongs to your total assets. And as you develop equity, you have the leverage to purchase more properties and raise cash flow and wealth much more.

Because realty is a substantial asset and one that can act as security, financing is readily offered. Genuine estate returns vary, depending on elements such as area, asset class, and management. Still, a number that several investors intend for is to defeat the average returns of the S&P 500what lots of people refer to when they say, "the marketplace." The inflation hedging capability of realty comes from the favorable connection between GDP growth and the demand genuine estate.

Property By Helander Llc for Beginners

This, in turn, converts into greater funding values. Consequently, property has a tendency to maintain the purchasing power of resources by passing a few of the inflationary pressure on lessees and by integrating several of the inflationary stress in the form of resources admiration. Mortgage borrowing discrimination is illegal. If you think you have actually been discriminated versus based on race, religion, sex, marriage standing, use public assistance, nationwide beginning, impairment, or age, there are actions you can take.Indirect real estate spending entails no straight possession of a building or homes. There are numerous methods that having actual estate can protect versus rising cost of living.

Homes funded with a fixed-rate finance will certainly see the loved one amount of the regular monthly mortgage repayments drop over time-- for circumstances $1,000 a month as a fixed repayment will certainly end up being much less burdensome as inflation wears down the purchasing power of that $1,000. https://www.goodreads.com/user/show/179989089-frederick-riley. Typically, a primary house is ruled out to be a property investment considering that it is utilized as one's home

An Unbiased View of Property By Helander Llc

Despite the assistance of a broker, it can take a few weeks of job simply to discover the ideal counterparty. Still, realty is a distinct possession class that's simple to recognize and can improve the risk-and-return profile of an investor's portfolio. By itself, realty provides money flow, tax breaks, equity structure, competitive risk-adjusted returns, and a bush against rising cost of living.

Purchasing realty can be an exceptionally satisfying and lucrative undertaking, however if you resemble a great deal of brand-new investors, you might be wondering WHY you need to be purchasing actual estate and what benefits it brings over various other financial investment opportunities. In enhancement to all the fantastic advantages that go along with investing in genuine estate, there are some downsides you need to consider also.

Top Guidelines Of Property By Helander Llc

At BuyProperly, we use a fractional possession model that enables investors to begin with as little as $2500. Another significant benefit of real estate investing is the ability to make a high return from buying, refurbishing, and marketing (a.k.a.Most flippers a lot of fins undervalued buildings underestimated great neighborhoodsExcellent The remarkable thing about spending in genuine estate is that the worth of the residential or commercial property is anticipated to value.

The Ultimate Guide To Property By Helander Llc

For instance, if you are billing $2,000 lease monthly and you incurred $1,500 in tax-deductible expenses monthly, you will just be paying tax obligation on that particular $500 earnings per month. That's a huge top article distinction from paying tax obligations on $2,000 monthly. The revenue that you make on your rental for the year is considered rental income and will certainly be tired as necessaryReport this wiki page